How Your Credit Utilization Affects Your Overall Credit Score

Did you know there are 5 factors that make up your credit score? Payment History is the big one. Always make sure you pay your debts on time, every time. Credit Age, or how long you’ve had your credit accounts is also important.

Then there’s Credit Mix, which is the variety of your accounts… Inquiries, how often you apply for credit, and Credit Utilization. This one gets confusing, so I’ll break it down for you.

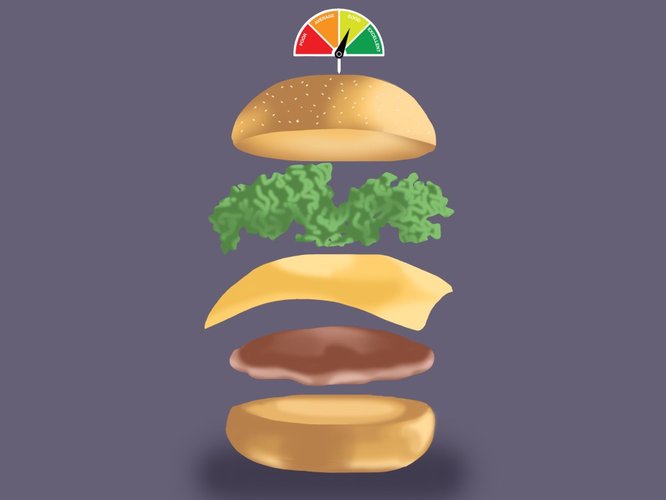

Simply put, Credit Utilization is the amount of credit card debt versus your total outstanding credit limit. Here’s an example: If you have a $2,000 credit limit, and you have $1,000 of debt, your credit utilization is 50%. The higher this percentage, the more it negatively affects your credit score.

So, if you’re maxed out on your credit cards, your credit score takes a serious hit. However, if you have high credit limits and regularly keep low balances, you’re rewarded with a higher credit score. And keep in mind that your credit utilization ratio counts nearly as much as your payment history. Therefore, even if you always pay on time, your high balance could be hurting your credit.

Thankfully, at Randash Auto Center, we don’t see you as a credit score number. We see you as a person who simply needs a car, truck or SUV. No matter your credit, we can help. Either we’ll help you to repair your credit, or help you find the right vehicle. Stop on by and visit one of our team members at our Billings or Bozeman locations.